Halving bitcoin

With the upcoming Bitcoin halving event on the horizon, many investors and enthusiasts are eager to learn more about its potential impact on the market. In order to gain a better understanding of what to expect, it's important to explore a variety of perspectives and insights from experts in the field. The following list of articles offers valuable information and analysis on the topic of Bitcoin's next halving, shedding light on its significance and potential implications for the cryptocurrency market.

The History of Bitcoin Halvings: A Look Back at Previous Events

As the world eagerly anticipates the upcoming Bitcoin halving event, it is crucial to reflect on the history of previous halvings and their impact on the cryptocurrency market. Bitcoin halvings, which occur approximately every four years, are significant events that have a direct effect on the supply and demand dynamics of the digital currency.

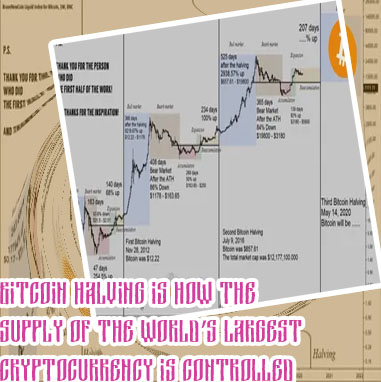

The first Bitcoin halving took place in November 2012, followed by the second halving in July 2016. On both occasions, the halving event led to a surge in the price of Bitcoin as the supply of new coins entering the market decreased. This scarcity drove up demand among investors, resulting in a bullish trend in the cryptocurrency market.

As we look back at these previous events, it becomes evident that Bitcoin halvings have historically been catalysts for price rallies and increased market interest. The upcoming halving, scheduled for May 2020, is expected to have a similar effect on the price of Bitcoin. Analysts predict that the halving will lead to a supply shock, potentially driving the price of Bitcoin to new heights.

In conclusion, understanding the history of Bitcoin halvings is crucial for investors and enthusiasts alike. By learning from past events, we can better prepare for the potential impact of the upcoming halving and make informed

What Does the Bitcoin Halving Mean for Miners and the Network?

The Bitcoin halving is a significant event in the cryptocurrency world that occurs approximately every four years. During this event, the number of new Bitcoins created and earned by miners is cut in half, leading to a decrease in the supply of new coins entering the market. This reduction in supply has a direct impact on miners and the overall network.

For miners, the halving means they receive fewer rewards for validating transactions and securing the network. This can lead to a decrease in profitability for miners, especially those with higher operating costs. As a result, some miners may be forced to shut down their operations or upgrade their equipment to remain competitive.

On the other hand, the halving also has positive implications for the network as a whole. The reduction in the supply of new coins can lead to an increase in the value of Bitcoin as scarcity drives up demand. This can benefit long-term holders and investors who believe in the potential of Bitcoin as a store of value.

In conclusion, the Bitcoin halving has both challenges and opportunities for miners and the network. To better understand the implications of the halving, it is important to consider factors such as mining difficulty, hash rate, and overall market sentiment. Additionally, staying informed about upcoming developments in the cryptocurrency space can help navigate the changes brought about by

Expert Predictions: How Will the Next Bitcoin Halving Affect Prices?

The upcoming Bitcoin halving event has been a topic of great interest and speculation among cryptocurrency enthusiasts and investors. The halving, which occurs approximately every four years, is when the reward that miners receive for verifying transactions on the Bitcoin network is cut in half. This reduction in supply has historically led to an increase in the price of Bitcoin.

Experts have differing opinions on how the next Bitcoin halving will affect prices. Some believe that the reduced supply of new Bitcoins will lead to a significant increase in price, as demand for the cryptocurrency continues to grow. Others argue that the halving event is already priced in by the market, and therefore may not have as big of an impact as in previous halving events.

It is important for investors and traders to closely monitor market trends and expert predictions leading up to the next halving event. Understanding the potential impact on prices can help individuals make informed decisions about their investments in Bitcoin. For those who are actively involved in the cryptocurrency market, staying informed about upcoming events such as the Bitcoin halving is crucial for success in this rapidly evolving industry.

Strategies for Investors: How to Prepare for the Bitcoin Halving

none