Bitcoin facts

Understanding Bitcoin Wallet Distribution: 4 Key Articles

Analyzing the Distribution of Bitcoin Wallets Across Different Geographical Regions

Today we are going to talk about the distribution of Bitcoin wallets across different geographical regions. This topic has gained significant attention in recent years as Bitcoin continues to grow in popularity around the world.

One key finding from the analysis is that the distribution of Bitcoin wallets is not evenly spread across the globe. In fact, a large portion of Bitcoin wallets are concentrated in North America and Europe, with Asia coming in third. This information can provide valuable insights into the adoption and use of Bitcoin in different parts of the world.

Understanding the distribution of Bitcoin wallets is important for a number of reasons. Firstly, it can help us better understand how Bitcoin is being used and adopted in different regions. This information can also be useful for businesses and policymakers looking to tap into the potential of Bitcoin in various markets.

Overall, analyzing the distribution of Bitcoin wallets across different geographical regions can provide valuable insights into the global adoption of this digital currency. It is an important topic that can help us better understand the impact of Bitcoin on a global scale.

The Impact of Large Whales on Bitcoin Wallet Distribution

Cryptocurrency markets are well-known for their volatility, with prices often experiencing drastic fluctuations in a short period of time. One factor that has been receiving increasing attention in the world of Bitcoin trading is the presence of large whales, or individuals or entities that hold significant amounts of cryptocurrency. These large whales have the ability to impact Bitcoin wallet distribution and consequently influence market trends.

Large whales are known to hold substantial amounts of Bitcoin in their wallets, giving them the power to manipulate prices by buying or selling large quantities of the cryptocurrency. This can create a ripple effect in the market, causing prices to surge or plummet depending on the actions of these large players. As a result, smaller investors and traders may find themselves at the mercy of these whales, who have the ability to significantly impact market dynamics.

Understanding the impact of large whales on Bitcoin wallet distribution is crucial for anyone involved in cryptocurrency trading. By keeping an eye on the movements of these whales and analyzing their behavior, traders can gain valuable insights into potential market trends and make more informed decisions when buying or selling Bitcoin. Ultimately, being aware of the influence of large whales can help traders navigate the volatile world of cryptocurrency more effectively and potentially enhance their chances of success in the market.

Examining the Role of Exchanges in Shaping Bitcoin Wallet Distribution

Bitcoin, a decentralized digital currency, has gained significant popularity in recent years. One key aspect of the Bitcoin ecosystem is the distribution of wallets, which are digital containers for storing bitcoins. A recent study titled "Examining the Role of Exchanges in Shaping Bitcoin Wallet Distribution" sheds light on how cryptocurrency exchanges play a crucial role in shaping this distribution.

The study highlights that exchanges act as key intermediaries between users and the Bitcoin network. By offering wallet services to users, exchanges play a pivotal role in determining the distribution of wallets across the network. The research finds that exchanges with a larger user base tend to have a greater influence on wallet distribution, as they attract more users to their platform.

Furthermore, the study reveals that exchanges with a diverse range of services, such as trading and lending, are more likely to attract a wider range of users. This diversification of services can lead to a more evenly distributed network of wallets, as users are drawn to exchanges for various reasons beyond simply buying and selling bitcoins.

Overall, this research underscores the importance of exchanges in shaping the distribution of Bitcoin wallets. By understanding the role of exchanges in the ecosystem, stakeholders can better comprehend the dynamics of the Bitcoin network and make informed decisions regarding wallet distribution strategies.

Strategies for Achieving a More Balanced Bitcoin Wallet Distribution

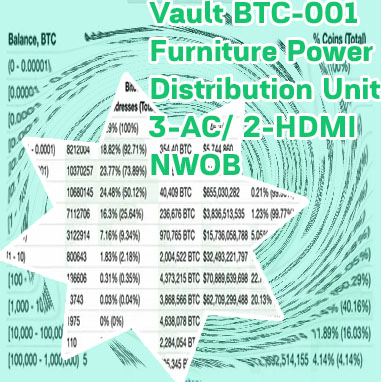

Bitcoin, the world's most popular cryptocurrency, has seen a surge in popularity in recent years. However, one major concern that has been raised is the uneven distribution of Bitcoin wallets. A small number of individuals and organizations hold a significant portion of the total supply, leading to a lack of decentralization. In order to achieve a more balanced distribution of Bitcoin wallets, several strategies can be implemented:

-

Education and Awareness: One of the key ways to achieve a more balanced distribution of Bitcoin wallets is through education and awareness. By educating individuals about the importance of decentralization and the risks associated with centralized control, more people may be motivated to diversify their holdings.

-

Incentives for Redistribution: Another strategy to achieve a more balanced distribution of Bitcoin wallets is by providing incentives for redistribution. This could include rewards for individuals who redistribute their holdings or penalties for those who hold a large portion of the supply.

-

Community Engagement: Engaging with the Bitcoin community is essential in achieving a more balanced distribution of wallets. By encouraging discussions and collaboration within the community, individuals may be more inclined to redistribute their holdings in order to promote decentralization.

-

Regulation: While Bitcoin is known for its decentralized nature, some form of regulation may be necessary to ensure a more balanced distribution of wallets