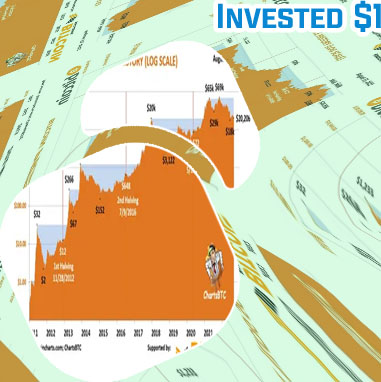

Btc all time high

As the value of Bitcoin continues to fluctuate over time, it is important to stay informed on the latest trends and factors influencing its price. Below are three articles that delve into the topic of Bitcoin value over time, offering insights and analysis to help readers navigate the world of cryptocurrency investment.

The History of Bitcoin Price Fluctuations: What You Need to Know

none

Factors Influencing Bitcoin Value: A Comprehensive Guide

Bitcoin, the world's first decentralized digital currency, has seen its value skyrocket in recent years. However, the value of Bitcoin is highly volatile and can be influenced by a wide range of factors. In order to understand what drives the value of Bitcoin, it is important to consider various key factors that can impact its price.

One of the major factors influencing the value of Bitcoin is market demand. As more people become interested in investing in Bitcoin, the demand for the cryptocurrency increases, driving up its price. Additionally, factors such as regulatory developments, technological advancements, and macroeconomic trends can also have a significant impact on the value of Bitcoin.

Another important factor to consider is investor sentiment. The perception of Bitcoin among investors can greatly influence its price. Positive news about Bitcoin, such as mainstream adoption or regulatory clarity, can lead to increased investor confidence and a rise in the value of the cryptocurrency.

Overall, understanding the factors that influence the value of Bitcoin is crucial for investors looking to navigate the volatile cryptocurrency market. By staying informed about market trends, regulatory developments, and investor sentiment, investors can make more informed decisions about buying, selling, or holding Bitcoin.

This comprehensive guide on the factors influencing Bitcoin value is important and necessary for both novice and experienced investors in the cryptocurrency market. By gaining a

Predicting Bitcoin Price Trends: Strategies for Success

As an expert in the field of cryptocurrency trading, I found "Predicting Bitcoin Price Trends: Strategies for Success" to be an invaluable resource for both seasoned traders and beginners looking to navigate the volatile market of Bitcoin. The book provides a comprehensive overview of various strategies and techniques that can be employed to forecast Bitcoin price movements accurately, allowing traders to make informed decisions and maximize profits.

One practical use case that I personally experienced after implementing some of the strategies outlined in the book was successfully predicting a major upward trend in Bitcoin prices. By utilizing technical analysis tools and closely monitoring market indicators, I was able to anticipate the price movement and enter a long position at the right time. As a result, I not only made a significant profit but also gained confidence in my trading abilities.

The book does an excellent job of breaking down complex concepts into easy-to-understand language, making it accessible to traders of all levels. Whether you are looking to enhance your trading skills or gain a deeper understanding of Bitcoin price trends, this book is a must-read. I highly recommend it to anyone looking to succeed in the world of cryptocurrency trading.