Crypto loans

How to buy crypto with credit card

How Does CeFi Crypto Lending Work?

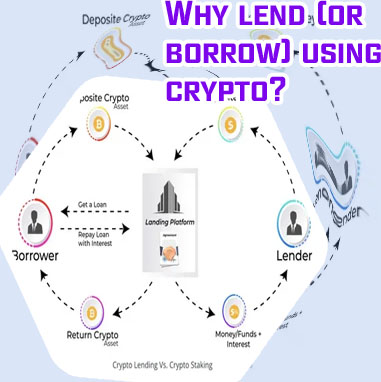

With crypto lending, you can earn interest from your crypto asset by depositing it into the lending platform. Depending on the platform, both individuals and corporations have faster access to loans than traditional lending platforms that are strictly navigated by state regulations, reliable credit scores, and various due diligence. Loan crypto Cryptocurrency lending is a way for crypto investors to borrow against their crypto assets, like Bitcoin or Ethereum, from other investors who can earn money on interest from the loans.

How to get a crypto loan

Learn about liquidations and how Celsius does everything they can to avoid them. Calculate your crypto loan In addition to instant USD and EUR loans, Nexo customers can also borrow instantly using a stablecoin such as USDT, which they can then exchange for a preferred cryptocurrency and/or convert into fiat.

Top decentralized crypto loan platforms

With centralized finance (CeFi), your money is held by banks and similar financial institutions. The financial system is full of third parties who facilitate money movement between parties. Banks are in control over the approval or disapproval of financial transactions. What Are the Categories of Crypto Loans? Despite the many benefits of crypto loans, crypto lending is not a risk-free endeavor. Crypto loans come with risks that you need to be aware of.

Crypto borrowing

Although not as easy to easy as Aave, Compound offers similar options: crypto loans and borrowing. In practice, Compound Finance also works similarly to Aave. Loan providers fund pools from which borrowers can borrow–if they have collateral to secure the loan. You’ll find fewer selections of cryptos to borrow compared to Aave, but because both platforms use variable rates, you might score a lower rate by keeping Compound Finance on your list of options. Compound only supports the Ethereum network. Could Blockchain be the Future of Loans? Please stand by, while we are checking your browser...